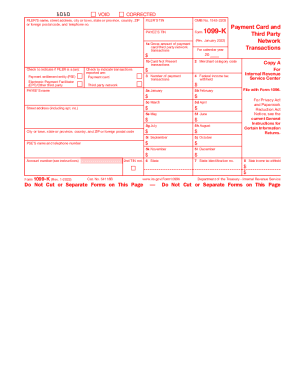

IRS 1099-K 2024-2026 free printable template

Instructions and Help about IRS 1099-K

How to edit IRS 1099-K

How to fill out IRS 1099-K

Latest updates to IRS 1099-K

All You Need to Know About IRS 1099-K

What is IRS 1099-K?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

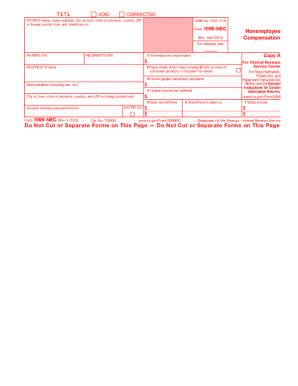

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1099-K

What should I do if I realize I've made an error on my submitted IRS 1099-K?

If you need to correct an error on your filed IRS 1099-K, you must file a corrected form. This is often done by marking the box indicating that it is a correction and providing the accurate details. Be sure to provide a copy of the corrected form to any parties who received the original.

How can I verify if my IRS 1099-K has been processed by the IRS?

To verify the status of your IRS 1099-K submission, you can contact the IRS directly or use the e-file system if applicable. The IRS website may also provide online tools to check the status of filed forms, including any rejections and their reasons.

What are the implications if I receive a notice regarding my IRS 1099-K?

Receiving a notice regarding your IRS 1099-K typically indicates that the IRS is seeking clarification or has identified an issue with your form. It's essential to respond quickly and provide any requested documentation while keeping records of all communications.

What common errors should I watch out for when filing an IRS 1099-K?

Common errors when filing an IRS 1099-K include incorrect taxpayer identification numbers, inaccuracies in reported payment amounts, and failing to check the required boxes on the form. Reviewing all details thoroughly before submission can help avoid these issues.

What should I know about e-signatures on my IRS 1099-K?

E-signatures are acceptable on the IRS 1099-K as long as they comply with IRS regulations. Ensure that your e-signature solution meets the requirements set forth by the IRS for electronic submission to maintain the validity of your filing.

See what our users say